CHI SQUARE ANALYSIS AND NULL HYPOTHESIS

This

test allows us to compare a collection of categorical data with some

theoretical expected distribution. This test is often used in genetics to

compare the results of a cross with the theoretical distribution based on

genetic theory. Suppose you preformed a simple monohybrid cross between two

individuals that were heterozygotes for the trait of interest.

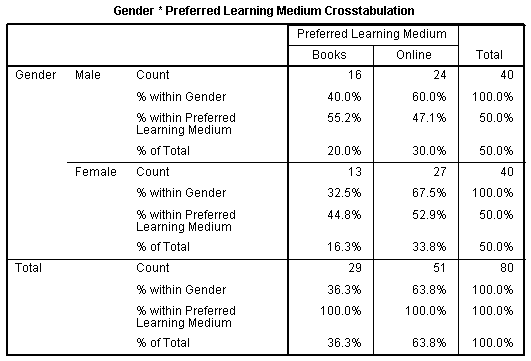

Cross-tabulation analysis has its own unique language, using

terms such as “banners”, “stubs”, “Chi-Square Statistic” and “Expected Values.”

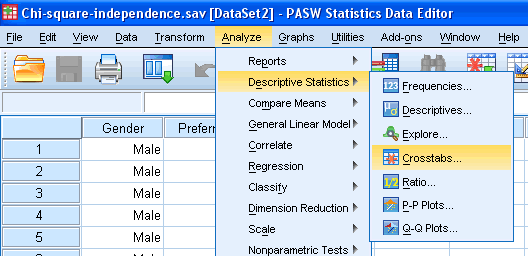

OUTPUT:

NULL HYPOTHESIS:

Hypothesis testing works by collecting

data and measuring how likely the particular set of

data is, assuming the null hypothesis is true. If the data-set is very

unlikely, defined as being part of a class of sets of data that only rarely

will be observed, the experimenter rejects the null hypothesis concluding it

(probably) is false.

If significant value is

less than 0.05 then null hypothesis will not be considered.Now we can said that

there is relationship between services &stores.In routine

business,significant value is around 0.05.

Correlation:

Correlation is computed into what is

known as the correlation coefficient, which ranges between -1 and +1. Perfect

positive correlation (a correlation co-efficient of +1) implies that as one

security moves, either up or down, the other security will move in lockstep, in

the same direction. Alternatively, perfect negative correlation means that if

one security moves in either direction the security that is perfectly

negatively correlated will move in the opposite direction. If the correlation

is 0, the movements of the securities are said to have no correlation; they are

completely random.

In real life, perfectly correlated securities are rare, rather you will find securities with some degree of correlation.

In real life, perfectly correlated securities are rare, rather you will find securities with some degree of correlation.

SUBMITTED BY:PALAK JAIN

GROUP MEMBERS:

NIDHI

NITESH SINGH PATEL

NITESH BORATWAR

PALLAVI BIZOARA

No comments:

Post a Comment